About us

Surge Energy America (Surge)

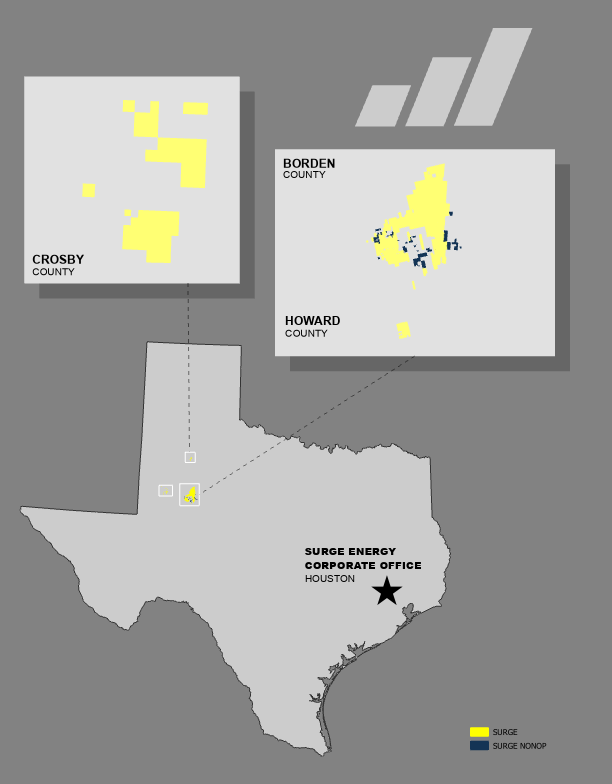

An independent oil and natural gas production company focused on developing and acquiring oil and natural gas reserves in the Texas Permian Basin. Our operations are in the state of Texas, with our headquarters in Houston and our acreage located in the energy-rich Permian Basin in West Texas. Surge employs nearly 200 hardworking Texans who have helped make us one of the state’s top 25 oil producers.

Surge continuously strives to be a different kind of company, one that thinks outside the box. We seek out innovative, responsible methods for enhancing our production. Surge is committed to protecting the environment and minimizing our operational impact by preventing spills and reducing emissions.

In addition to striving for sustainable resource development, we value our employees as Surge’s greatest asset and are dedicated to giving back to our communities through philanthropic efforts.

Our History

May: Executive team and first hired staff join newly formed Surge Energy.

Nov: Close on acquisition of Moss Creek Field, a 76,000 acre leasehold stretching between northern Howard County and southern Borden County in Texas.

Mar: Surge Energy begins operating Moss Creek, taking on 6,500 BOE/D and running 1 drilling rig.

Apr: First well drilled by Surge Energy in Moss Creek begins producing.

Aug: Surge Energy doubles production in less than one year from close of Moss Creek acquisition.

Dec: Exit the year at a production rate of approximately 16 MBOE/D (annual average of 10 MBOE/D) and running 4 rigs.

Aug: Surge’s Elrod Recycle Facility commences operations, allowing for the use of produced water instead of fresh water for Surge’s well completions, reducing costs and environmental impact.

Dec: Surge Energy exits the year at a rate of approximately 32 MBOE/D (annual average of 25 MBOE/D) running 6 rigs.

Jan: Surge Energy issues $700MM of High Yield Bonds.

July: Surge Energy reaches $1 Billion in sales since inception.

Aug: Surge Energy transitions to utilizing recycled water in 100% of well completions.

Dec: Exit the year at a production rate of approximately 43 MBOE/D (annual average of 40 MBOE/D).

December: End Year Production Rate: 43 MBOE/D

May: Surge Energy issues additional $500MM of High Yield Bonds.

July: Surge Energy completes the longest known lateral in the Permian Basin of 3.4 Miles and is selected as an honoree for the Houston Business Journal’s 2019 Inaugural Innovation Awards.

Oct: Surge Energy reaches $2 Billion in sales since inception and closes acquisition on Cordero acreage, adding 6,000 net acres to the Moss Creek development area.

Dec: Finalize 2019 with an annual average production rate of 51 MBOE/D.

April: Surge reaches five year anniversary of closing on first acquisition and surpasses cumulative production of 50MM net MBOE since inception.

Aug: Surge Energy is recognized in Houston Business Journal’s Best Places to Work and Middle Market 50 Lists for 2020. Surge is the only upstream oil and gas company to be recognized on both lists.

March: Close on the acquisition of approximately 18,000 of net leasehold acreage and approximately 9,000 BOED of existing production from Grenadier Energy Partners.

June: Surge reaches a new production milestone of 100 million gross BOE produced since the company’s inception.

July: Close on acquisition of approximately 4,000 net leasehold acreage and approximately 800 BOED primarily in Howard County

July: Commissioned fourth recycling facility, allowing the Company to return to exclusively using recycled, produced water for completion operations

December: Commissioned the Phoenix Substation, the Company’s electrical substation that reduces the need for well site generators and therefore reduces both cost and emissions

February: Relocate Surge Energy’s corporate headquarters to Westway Plaza located at 11330 Clay Road in Houston, Texas.

December: Finalize 2023 with an annual average production rate of 61 MBOE/D.

June: Surge Energy achieves a cumulative 6 billion+ freshwater gallons conserved and 365 thousand+ metric tons of CO2e eliminated from our West Texas operations since the company’s inception.

August: Surge issues $750MM of High Yield Bonds, retiring existing 2026 and 2027 senior notes and saving $25MM in annual interest.

December: Surge achieves a record YTD average production rate of 62 MBOE/D, the lowest leverage ratio, highest liquidity, and the best completion efficiency in the company’s history.

February: North Borden 52,000 acreage expansion.